What Do You Mean When You Say PDP?

Welcome to the wild world of Medicare prescription drug plans! If the idea of navigating your Medicare drug plan sounds like trying to understand a Shakespearean play with a side of quantum physics, don’t worry—you are not alone. That’s where we come in; we are here to break it down for you with a dash of humor and a sprinkle of simplicity. So, grab your cup of coffee, and let’s dive into the ins and outs of Medicare’s prescription drug plans.

What on Earth is a Part D Plan?

Part D is like the unpredictable wild child at the family barbecue—you never quite know what to expect. It’s a plan that specifically helps cover the cost of your prescription medications at the pharmacy. This is an essential part of your Medicare bundle. We strongly advise you to pick a plan when you sign up for Medicare, even if you are not currently on any medications. If you don’t enroll when you’re first eligible, you may face a lifetime penalty if you do sign up later. After all, as you age, you’re likely to need more medications.

How do we help you pick your plan?

We consider a few things when guiding you on what plan will fit your current need.

- What medications are you currently taking? This is the most important matter to consider. If you are on one inexpensive, generic medicine, then a basic, low-cost plan will be best for you. If you take several name brand, high-cost drugs…welp you got it— you need a more expensive plan with better coverage. More coverage costs more money.

- What is your preferred pharmacy? We will do our best to find a plan that fits seamlessly into your routine.

- Using tools and resources available to us, we can compare plans to find the ones that best match your medication list and budget. We will provide a clear explanation of the various Part D plans available including deductibles, coinsurance, copays and other expenses you can expect throughout the year

The Phases of Prescription Drug Plan

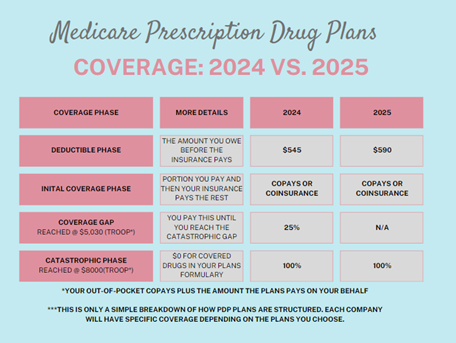

Deductible Phase:

We like to call this the “You Pay” Phase. Essentially, you are footing the bill at the pharmacy until this amount is met on your plan. Some plans waive the deductible or offer a lower deductible, all depends on the plan you choose.

Initial Coverage Phase:

Once you’ve met your deductible, you enter the initial coverage phase. During this phase, you’ll pay either a copay or a percentage (coinsurance) for your prescriptions. Both you and the insurance company share the cost, and these payments contribute to your True Out-of-Pocket (TrOOP) amount. For example, if Bette picks up her medication at the pharmacy, she pays a $20 copay. If her insurance covers $47.23, then $67.23 is added to her TrOOP amount. This amount is used to determine when you will enter the next two phases: the coverage gap (often called the “donut hole”) and the catastrophic coverage phase. The thresholds for these phases are set each year by CMS.

The Donut Hole— Not a Delicious Dessert (but fortunately she is going away in 2025!)

The Medicare Part D coverage gap, affectionately known as the “donut hole,” might sound like a sweet treat, but it’s a phase where you could face higher out-of-pocket costs for your medications. During this period, after you and your plan have spent a certain amount on drugs, you’ll be responsible for a larger share of the costs until you reach the next coverage level. The good news is that this coverage gap is being phased out.

Catastrophic Gap Phase- (It’s like leveling up in your favorite video game, Super Saver Mode)

If you’ve reached this point in your plan, congratulations! Your wallet will soon get a break. Once you’ve spent up to the cap on your True Out-of-Pocket (TrOOP) costs—$8,000 for 2024—your Medicare Part D plan will cover 100% of your prescription costs. This means you won’t have to pay anything more for your medications for the rest of the year.

***Hot off the press: The only constant is change. For 2025, this is a big change.

Starting January 1, 2025, the dreaded coverage gap (also known as the “donut hole”) will be a thing of the past. Instead, there will be a $2,000 maximum out-of-pocket limit for prescription drugs, meaning that’s the most you’ll pay in a year. Once you hit this cap, the insurance company will cover the rest. While this sounds fantastic for consumers, there’s a catch: the added cost to insurance companies might lead to higher premiums for you. So, enjoy the savings, but keep an eye on those premium hikes!

These plans can be confusing. We recommend that you call us to discuss. We are happy to assist you with this part of Medicare.